amazon flex after taxes

Get started now to reserve blocks in advance or pick them daily based on your schedule. So you make 100 for 3 hours of work increasing your rate from 20 an hour to around 33 an hour.

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Ad We know how valuable your time is.

. Look into paying estimated taxes because none is being withheld -- or the IRS will get testy with you read. It has 33 stars on average on Indeed. It usually takes about 2-5 business days to hear back from Amazon and once you are accepted there are basically two ways to go about the delivery.

But instead of it taking you four hours to make all of your deliveries you managed to make them in three hours. After you sign up to deliver for Amazon Flex youll use the app to start scheduling and making your deliveries. Amazon Flex quartly tax payments.

Amazon wants customers to be able to get their merchandise within an hour no matter what day of the week it is. With Amazon Flex you work only when you want to. Unfortunately not everyone has had a wonderful experience with Amazon Flex and there are a fair amount of negative reviews.

You can plan your week by reserving blocks in advance or picking them each day based on your availability. Amazon Flex Driver Current Employee - Houston TX - November 12 2019 Amazon flex not twenty an hour after you factor Gas taxes and stops. Amazon Flex Rewards is a program exclusively for Amazon Flex delivery partners to thank you for all the work you do.

And Amazon pays you 25 an hour so 100 for the whole block. Amazon started this program at the end of 2015 in Seattle. Access to dependable motorized vehicle.

We know how valuable your time is. You can make sure you dont forget these extremely important dates each year by. Amazon Flex Reviews Online.

Amazon Flex says it may take up to 10 business days. The earlier you sign up to drive the more likely youll get to claim the time slots you want. With Amazon Flex Rewards you can earn cash back with the Amazon Flex Debit Card enjoy Preferred Scheduling and access thousands of discounts as well as tools to navigate things like insurance and taxes.

Keep in mind that Amazon does not withhold or. Amazon Flex pays out earnings on a weekly basis for base pay and tips for the previous 7 days on every Wednesday. Beyond just mileage or car expenses getting a 1099 from Amazon means that you can claim a lot of other expenses as tax write offs -- the phone you use to call residents with a locked gate the insurance and down payments on.

But now the program is available in Arlington Atlanta Austin Baltimore Cincinnati. In your example you made 10000 on your 1099 and drove 10000 miles. Choose the blocks that fit your schedule then get back to living your life.

You can choose your hours but they are generally in 3-6 hour-long blocks. 35 hrs 45 around 35-43 parcels to drop off. Individuals C corporations sole proprietors single-member LLCs or LLCs taxed as corporations are required to file taxes by April 18 2022.

For this you need to enter the dates in the calendar feature. First you work on the days that you are only available. Although youre responsible.

This is your business income on which you owe taxes. Amazon offers employees generous benefits including RSUs and a 401k plan. I started driving for Amazon Flex in November yet only found out about the standard mileage deduction last week.

Businesses such as partnerships S corporations or LLCs that are taxed as partnerships are required to file taxes by March 15 2022. Adjust your work not your life. You can make closer to 25 per hour by using a larger car which makes you eligible to deliver more packagesAnother option is to claim blocks during busy.

The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and. Understand that this has nothing to do with whether you take the standard deduction. Knowing your tax write offs can be a good way to keep that income in your pocket.

The IRS requires you to keep your mileage log for three years from the date on which you file the income tax return containing your deduction. Driving for Amazon flex can be a good way to earn supplemental income. Youre an independent contractor.

This is really no different than any other gig app except that Amazon only takes so many people at. You may also choose a Roth 401K which means after-tax contributions. Please be sure to arrive on time.

If you arrive five minutes after your block start time the app will not allow you to deliver and it will be considered it a missed block. You pay 153 for 2014 SE tax on 9235 of your Net Profit greater than 400. So they provide different shifts to drivers.

After you submit that information sit tight while the background check is processed. Once your direct deposit is on its way Amazon Flex will send you an email to let you know. This form will have you adjust your 1099 income for the number of miles driven.

Welcome to the AmazonFlex Community where AmazonFlex Drivers come together. With Amazon Flex you work only when you want to. You pay standard taxes on your paycheck and the 401K withdrawals are made after taxes.

Amazon Flexs website claims you can earn anywhere between 18-25 per hour by making deliveries from Amazon warehouses or partner restaurants. There are no set hours for this job. Before accepting jobs youll need to submit additional info including a photo copy of your drivers license tax and bank account information and your Social Security number.

Amazon Flex Driver Current. Fine you in the spring because youll be under-withheld. It has 25 stars on average on Glass Door right now.

For additional information click on 2017 Publication 463 - IRSgov Chapter 5 page. The negative reviews largely mention things like. 3hrs 39 around 26 -30 parcels to drop off sometimes more if a customer has 2 or 3 parcels each.

It has 25 stars on average on Glass Door right now. Here are the crucial things you need to understand if you work there. The Amazon Flex app provides the start location at least 1 hours before your block start time and also provides suggested turn-by-turn navigation to get to the location.

Self Employment tax Scheduled SE is generated if a person has 400 or more of net profit from self-employment on Schedule C. Im wasnt directly employed by Amazon Im whats known as a flex driver I use the Flex app to take a block delivery slot time that suits my daily schedulethese blocks can range from 3hrs to 5 hrs. Here are a few things to know about scheduling in the app.

Youre not considered an employee of Amazon through the Flex program so youll need to sort out your tax situation and business expenses eg mileage on your own. You are required to provide a bank account for direct deposit which can take up to 5 days to process.

How To Get Amazon Flex Spark Walmart Blocks Like A Pro No Bot No Autoclicker Youtube Flex Amazon Amazon Flex Driver

How To Do Taxes For Amazon Flex Youtube

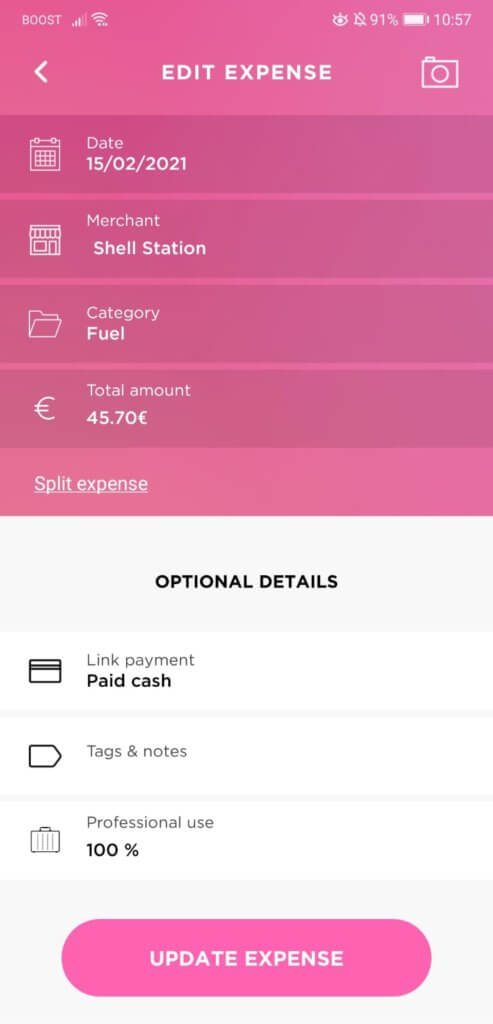

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Teclast F5 Touch Screen Laptop Intel 8gb Ram 256gb Ssd Windows10 1920 1080 Quick Charge 360 Rotating Touch Screen 11 6 In 2022 Touch Screen Laptop Laptop Touch Screen

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Does Amazon Flex Take Out Taxes In 2022 Complete Guide

![]()

Irs Uber Mileage Log Tax Deduction With Triplog Tracking App Tracking App Tax Deductions Mileage

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Amazon Sales Tax Accounting Tips For Amazon Sellers

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To File Amazon Flex 1099 Taxes The Easy Way

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Income Strategies How To Create A Tax Efficient Withdrawal Strategy To Generate Retirement Income William Reichenstein 9780578555089 Books Amazon Com

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable